Exness Standard Accounts

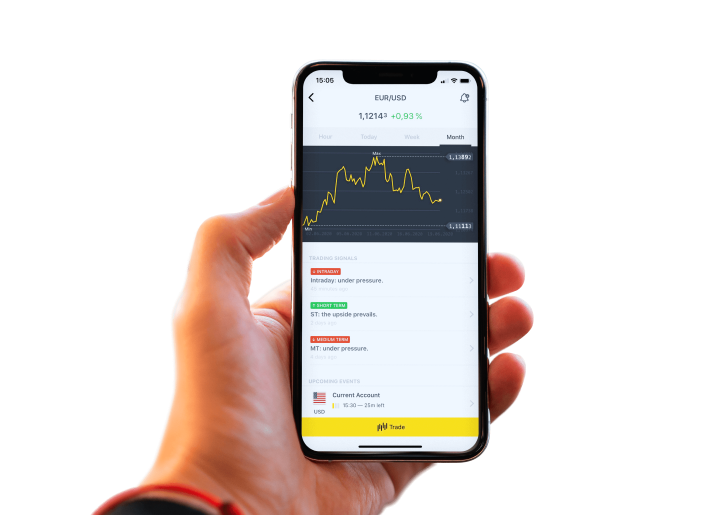

Exness Standard Accounts offer a gateway to the world of forex trading through its user-friendly platform and accessible features. As part of Exness, a renowned trading provider, Standard Accounts cater to traders of varying experience levels, providing a solid foundation for those starting their trading journey. These accounts are designed to offer competitive trading conditions, essential tools, and a seamless trading experience, making them an attractive choice for both beginners and seasoned traders alike.

Key Features of Exness Standard Accounts

Exness Standard Accounts offer traders competitive trading conditions with tight spreads and flexible leverage options, ensuring efficient trade execution across a diverse range of trading instruments. These accounts provide accessibility to traders of all levels, supported by a user-friendly platform and transparent pricing with no hidden fees or commissions.

Key Features of Exness Standard Accounts:

- Competitive Trading Conditions: Exness Standard Accounts offer competitive spreads and leverage options, allowing traders to execute trades efficiently and cost-effectively across a wide range of currency pairs.

- Accessibility: These accounts are accessible to traders of all levels, making it easy for beginners to enter the forex market while still providing advanced features for experienced traders to optimize their strategies.

- Secure and Reliable: Exness prioritizes the security of its users’ funds and information, employing robust encryption methods and adhering to strict regulatory standards to ensure a safe trading environment.

- Flexible Trading Tools: Standard Accounts provide access to a variety of trading tools and resources, including customizable charts, technical analysis indicators, and risk management features, empowering traders to make informed decisions.

- Transparent Pricing: With Exness, traders benefit from transparent pricing and low trading costs, as the platform does not charge hidden fees or commissions on trades, allowing for greater transparency and clarity in trading transactions.

- Responsive Customer Support: Exness offers responsive customer support services, ensuring that traders receive timely assistance and guidance whenever they encounter issues or have inquiries about their accounts or trading activities.

Registration Process of Exness Standard Account

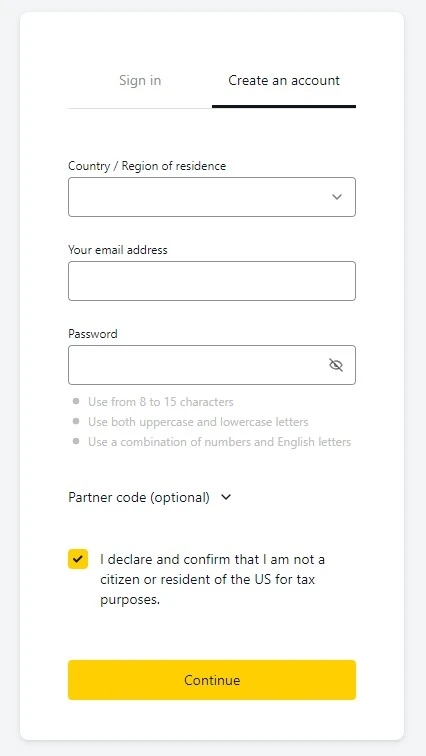

The registration process for an Exness Standard Account is simple and can be completed in a few easy steps:

- Visit the Exness website: Go to the official Exness website using your web browser.

- Click on “Sign Up” or “Open Account”: Look for the “Sign Up” or “Open Account” button on the homepage and click on it to begin the registration process.

- Fill in your details: You’ll be directed to a registration form where you’ll need to provide basic information such as your name, email address, country of residence, and preferred account currency.

- Choose your account type: Select the “Standard Account” option from the available account types. Review the account specifications to ensure it meets your trading requirements.

- Agree to the terms and conditions: Read and agree to the terms and conditions of Exness by checking the box provided.

- Verify your email: After submitting the registration form, you’ll receive a verification email from Exness. Click on the verification link within the email to confirm your email address and proceed with the registration process.

- Complete additional verification (if required): Depending on your country of residence and regulatory requirements, you may need to complete additional verification steps to verify your identity and address. This typically involves uploading a copy of your passport or ID card and a recent utility bill or bank statement.

- Fund your account: Once your account is verified, you can fund it using one of the available deposit methods supported by Exness, such as bank transfers, credit/debit cards, or electronic payment systems.

- Start trading: With your account funded and verified, you can start trading on the Exness platform using the Standard Account. Log in to your account using the credentials provided during registration and explore the available currency pairs, place trades, and monitor your positions.

Exness Standard Account Verification Requirements

To ensure compliance with regulatory standards and maintain a secure trading environment, Exness imposes verification requirements for Standard Accounts. Here are the typical verification requirements:

Identity Verification:

- Valid government-issued photo ID: Passport, driver’s license, or national ID card.

- Ensure the ID is not expired and all details are clearly visible.

Address Verification:

- Recent utility bill: Electricity, water, gas, or landline phone bill.

- Bank statement: Showing your name and residential address.

- Official government document: Such as a tax statement or residency certificate.

- The document should be dated within the last three months and show your full name and current residential address.

Additional Documentation (if necessary):

- Proof of income: Payslip, tax return, or bank statement showing regular income deposits.

- Source of funds: Documentation proving the source of funds used for trading activities, such as inheritance, sale of property, or business earnings.

- Declaration of purpose of trading: A statement explaining your trading objectives and intentions.

It’s essential to ensure that all documents provided meet Exness’ verification standards to avoid delays in the verification process.

Account Funding Options at Exness Standard Account

Exness offers a variety of convenient account funding options for Standard Accounts, catering to the diverse needs of traders worldwide. Here are some common funding methods available:

Bank Wire Transfer:

- Transfer funds directly from your bank account to your Exness trading account.

- Typically, this method may take 1-5 business days for the funds to reflect in your account.

- Suitable for larger transactions or traders who prefer traditional banking methods.

Credit/Debit Cards:

- Use major credit or debit cards, such as Visa, Mastercard, or Maestro, to fund your Exness account.

- Instant deposit processing, allowing you to start trading immediately.

- Widely accepted and convenient for smaller transactions.

Electronic Payment Systems:

- Utilize popular electronic payment systems like Neteller, Skrill, WebMoney, and Perfect Money.

- Fast and secure transactions, with funds typically credited to your account instantly or within minutes.

- Ideal for traders who prefer online payment platforms for their simplicity and speed.

Local Payment Methods:

- Depending on your region, Exness may offer local payment methods tailored to specific countries or regions.

- These methods may include online banking transfers, prepaid cards, or other localized payment solutions.

- Provides flexibility and convenience for traders who prefer local payment options.

It’s important to note that the availability of funding methods may vary depending on your country of residence and the specific policies of Exness. Before initiating a deposit, ensure to check the available funding options and any associated fees or processing times.

Conclusion

Exness Standard Accounts offer a comprehensive and user-friendly platform for traders of all levels to engage in the forex market. With competitive trading conditions, transparent pricing, and a wide range of trading instruments, these accounts provide ample opportunities for traders to achieve their financial goals.

The accessibility of Exness Standard Accounts ensures that both beginners and experienced professionals can participate in the forex market with confidence. Traders benefit from advanced trading tools, responsive customer support, and educational resources that empower them to make informed decisions and navigate the markets effectively.

FAQ for Exness Standard Accounts

What is an Exness Standard Account?

An Exness Standard Account is a type of trading account offered by Exness, providing access to the forex market with competitive trading conditions and a wide range of trading instruments.

How do I open an Exness Standard Account?

To open an Exness Standard Account, simply visit the Exness website, click on “Sign Up” or “Open Account,” and follow the registration process. Provide the required information, select the Standard Account type, and complete the verification process.

What are the trading conditions of Exness Standard Accounts?

Exness Standard Accounts offer competitive trading conditions, including tight spreads, flexible leverage options, and transparent pricing with no hidden fees or commissions on trades.

What trading instruments are available with Exness Standard Accounts?

With an Exness Standard Account, traders have access to a wide range of trading instruments, including currency pairs, commodities, indices, and cryptocurrencies.

How can I fund my Exness Standard Account?

Exness provides various funding options for Standard Accounts, including bank wire transfer, credit/debit cards, electronic payment systems, and cryptocurrencies.